这是一篇英国的商业环境限时测试作业代写

NOTE:

- The total marks for this online assessment paper is 100.

- This online assessment constitutes 60% of the total marks for this module.

- The marks for each question are indicated in square brackets [ ]

INSTRUCTIONS TO STUDENTS

- Answer ALL questions in Section A = 75% of available marks

- Answer ALL questions in Section B = 25% of available marks

- Clearly write the number and parts of questions attempted at the start of each answer in the extreme left column of answer document.

- Complete your quantitative answers, then scan or take photo and copy your work on to electronic answer document provided. You can also type answers directly on to electronic answer document.

- Do not change the formatting parameters on electronic answer document.

- DO NOT convert electronic answer document to PDF file format.

- Show all detailed workings.

- Full marks will ONLY be given for full and detailed answers.

- Ensure that you upload the correct answer booklet.

- Please use a desk calculator as opposed to a phone calculator.

SECTION A – Answer all questions

Question A1

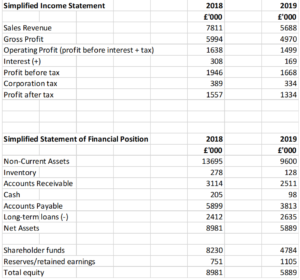

Industrial Solutions plc has been established for 8 years and the following financial data is provided for the financial years 2018 and 2019.

Extract from Annual Report & Accounts

(a) Use the simplified accounts shown above to calculate the following ratios for both years 2018 and 2019:

i) Profitability (2 ratios required – 1 to be ROCE) = 4 marks

ii) Gearing (1 ratio) = 2 marks

iii) Liquidity (2 ratios required) = 4 marks

iv) Efficiency (1 ratio) = 2 marks

(b) Using your ratio calculations from question A1 (a) – please comment upon the changes in Industrial Solution’s financial position over the two trading years under the following analysis areas:-

Profitability

Gearing

Liquidity

Efficiency

Question A2

(a) Using the data provided in Question A1, calculate the monetary amount of working capital Industrial Solutions had available for both 2018 and 2019 trading years?

(b) Explain the ways in which Industrial Solutions could improve its working capital position.

Question A3

Two best friends from dental school have decided to set up their own dental surgery. They cannot decide whether to form a partnership or a limited company.Discuss the advantages and disadvantages of both business formations,including the position regarding any debt the business may have.

Question A4

All types and sizes of businesses need finance to operate, whether they are a small start-up business or a large multinational company expanding into new countries.

(a) Identify and briefly outline two internal and two external sources of finance available to business entities.

(b) Identify the sources of finance that may be available to a new start-up business and explain the range of factors that will influence the lender’s decision.

(c) Business Loans Bank has declined Flyaway plc loan request, saying ‘the Company is too highly geared’. Explain what this means and what options are now available to Flyaway plc.