本次澳洲代写是投资组合分析的一个project

Introduction

The aimof this project is to prepare, evaluate and analyse stockmarket data and to recommend an optimal portfolio consisting of two stocks. You have been assigned three stocks, all threemust be included in the analysis which works towards your recommendation of a final optimal portfolio. The project requires a deep understanding of both the statistics and the mathematics components of this unit. It is recommended that you work on this on a weekly basis.

Refer to the rubric at the end of this document to understand howthis assessmentwill be graded. In particular, note that all figures need to be numbered and labelled, and you need to include all the steps to involved with arriving at each of your answers.

1 Import Data

Import the adjusted stock prices for the three stocks which you have been assigned. See the Markdown file for hints.

2 The Analysis

2.1 Plot prices over time

Plot the prices of each asset over time separately. Succinctly describe in words the evolution of each asset over time. (limit: 100 words for each time series).

2.2 Calculate returns and plot returns over time

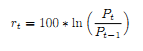

Calculate the daily percentage returns of each asset using the following formula:

Where Pt is the asset price at time t. Then plot the returns for each asset over time.

2.3 Histogramof returns

Create a histogramfor each of the returns series (explain how you determined the number of bins to use).

2.4 Summary table of returns

Report the descriptive statistics in a single table which includes themean,median, variance, standard deviation, skewness and kurtosis for each series. What conclusions can you draw fromthese descriptive statistics?

2.5 Are average returns significantly different fromzero?

Under the assumption that the returns of each asset are drawn froman independently and identically distributed normal distribution, are the expected returns of each asset statistically different fromzero at the 1%level of significance? Provide details for all 5 steps to conduct a hypothesis test, including the equation for the test statistic.

Calculate and report all the relevant values for your conclusion and be sure to provide an interpretation of the results.

2.6 Are average returns different fromeach other?

Assume the returns of each asset are independent from each other. With this assumption, are the mean returns statistically different from each other at the 1% level of significance? Provide details for all 5 steps to conduct each of the hypothesis tests usingwhat your have learned in the unit. Calculate and report all the relevant values for your conclusion and be sure to provide and interpretation of the results. (Hint: You need to discuss the equality of variances to determine which type of test to use.)

2.7 Correlations

Calculate and present the correlationmatrix of the returns. Discuss the direction and strength of the correlations.

2.8 Testing the significance of correlations

Is the assumption of independence of stock returns realistic? Provide evidence (the hypothesis test including all 5 steps of the hypothesis test and the equation for the test statistic) and a rationale to support your conclusion.