这是一个计量经济学的作业代写

The solution of the assignment should be written in the form of a self-contained report that

follows the style of an academic article. The results should be presented in a clear and concise

way with a detailed discussion and interpretation of the key findings.

A Matlab, R or Python file with the code used for the assignment has to be submitted as a

separate file along with the pdf of the assignment. Do not include the code in the main pdf

file of the assignment. The code should be clear and well commented.

Nonlinear time series – Theory part

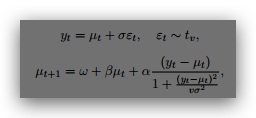

The report should contain a formal discussion of the stochastic properties and estimation theory

of the following robust score-driven model

where !, β, α, σ > 0 and v > 1 are parameters to be estimated, and tv denotes a Student’s t

distribution with v degrees of freedom.

In particular, the following points should be covered:

1. Derive conditions for stationarity and ergodicity of the process.

2. Derive conditions for the invertibility of the filtered time-varying parameter.

3. Show the consistency of the Maximum Likelihood estimator of the parameter vector θ =

(!; β; α; σ2; v)0.

Notes: (i) write and explain all steps in detail. (ii) you should try to formally show also the steps in question 3 that

we have not discussed in detail during the course, such as identification. (iii) if there are things that you cannot show

you may assume they hold and move on.

Filtering inflation – Empirical part

The report should contain an empirical analysis of the US headline inflation series by comparing

different filtering methods. The dataset CPI US.csv contains the monthly US consumer price index

(CPI) from January 1955 to November 2021. The series of interest is the headline inflation series

(CPI inflation), which can be obtained by taking log-differences of the CPI, i.e. yt = 100×(log(pt)−

log(pt−1)).

In particular, the report should cover the following points:

1. Estimate the robust observation-driven model presented in the theory part by Maximum

Likelihood. Report estimation results: parameter estimates, standard errors, log-likelihood,

plot estimated conditional mean µt.

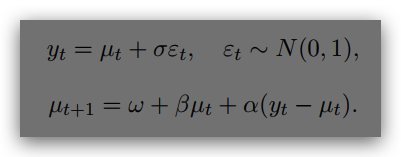

2. Compare estimation results with Gaussian version of the model, given by

3. Compare the performance of the two models in modeling the headline inflation series. Notes: (i)

analyses should include in-sample fit measures, out-of-sample metrics and diagnostic tests you find appropriate.

(ii) if you have not managed to estimate the models, you can still provide an answer to this question by

explaining in detail the analyses you would carry out and provide a justification for their use.

4. Discuss and implement possible extensions of the models that you find suitable to better

describe the headline inflation series. Validate empirically the performance of the extensions.