本次泰国作业案例是一个金融代写Exercise

Exercises #12

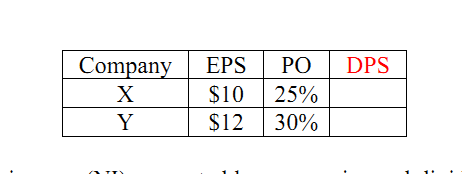

1. Given earnings per share (EPS) and dividend payout ratio (PO), compute dividend per

share (DPS):

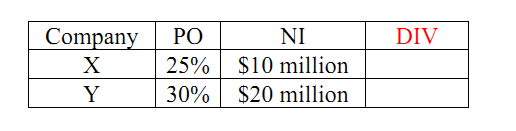

2. Given total net income (NI) generated by companies and dividend payout ratio (PO),

compute total dividend payment:

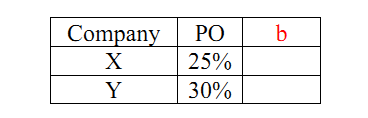

3. Given dividend payout ratio (PO), compute retention ratio (b):

4. Refer to Question 3 from the textbook (End of Chapter 16’s exercise):

Paylin Enterprises has declared a $3 dividend for its common stock. On the day

before the ex-dividend date, the firm’s shares are trading for $28 a share. What do

you expect the price of Paylin’s share to be on the day following the ex-dividend

date? Why do you expect the stock price to change?

5. Given the following information of XX-Corporation:

• Stock price is $10.

• Number of common shares outstanding are 1,000,000.

5.1 What would be the share price and number of common shares outstanding

after the company announces to pay 25% stock dividend?

5.2 What would be the share price and number of common shares outstanding

after the company announces to do a four-for-one stock split?