这是一个英国的R金融作业代写

• You should submit a single pdf solution containing answers to all sub-parts of all problems. Type

written solutions are preferred but handwritten and scanned solutions are acceptable. You may use

R-markdown, LaTeX, or any other software to prepare your solution, but please prepare a PDF.

• Marks for each problem are listed below. Within each problem sub-parts are equally weighted.

• In addition, please submit code for problems 4-5 in the form of an R project. This should be a zipped

folder that contains an R Project and a single R file with answers to all relevant parts of all problems.

I should be able to download and run your R file directly. Please comment your code to make it as

easy to interpret as possible.

• Your marks depend on clarity of exposition in solutions and code. This includes figures and regression

results.

• You may discuss all problems with classmates but each student must independently write and submit

their own solution. Solutions and code that have been clearly copied will cause the full assignment to

receive 0 marks and may invite further disciplinary action.

Problem 1 (10 Marks)

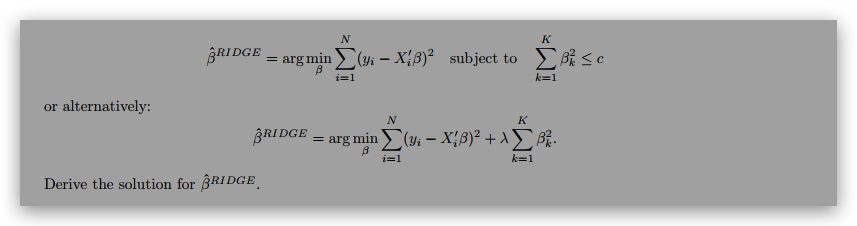

We defined the objective function for RIDGE as:

Problem 2 (10 Marks)

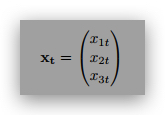

Suppose we see excess returns on three assets (i = 1; 2; 3) over many time periods (indexed by t): xit. We

may write these together as a vector at time t:

Suppose these returns are driven by the following two factor model:

xit = αi + β1if1;t + β2if2;t + “it:

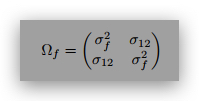

Let the covariance matrix of f1;t and f2;t be given by:

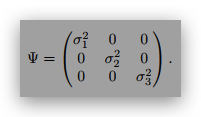

and the covariance matrix of “it be given by:

You may assume that Cov(fkt; “it0) = 0 for any k, i, t and t0, and that both fk;t and “it are uncorrelated

over time.

(a) Write the covariance matrix of asset returns: Σx = Cov(xt). You may use matrix notation, but please

comprehensively define all terms.

(b) Suppose we observed f1 and f2, but not β1i or β2i. Suppose we see a very large number of time periods

T (you may assume T ! 1). Describe a method for consistently estimating β1i and β2i.